Interest Rate: Enter the loan’s interest rate.The calculator uses this amount to set the loan amount.

To use MoneyGeek's mortgage calculator, you'll need to provide a few simple numbers to determine your home costs.

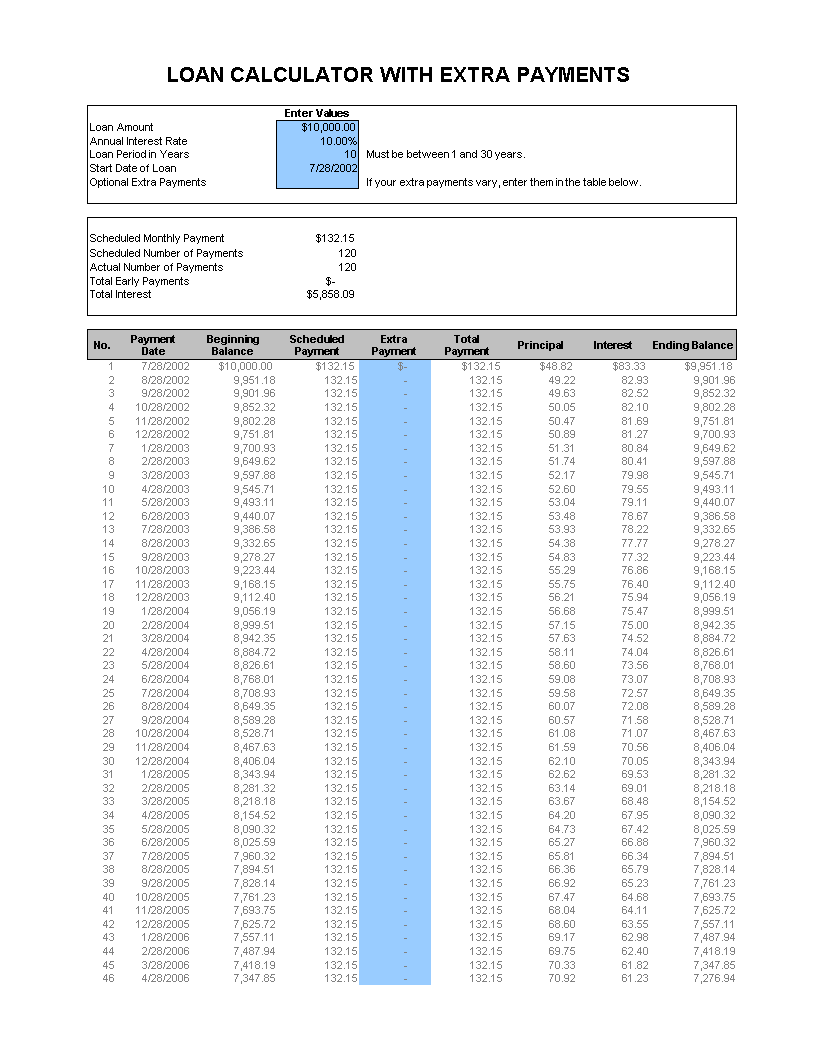

Extra payment mortgage calculator report how to#

How to Use the MoneyGeek Mortgage Calculator Paying off a mortgage early: Under the “Schedule” tab, input one-time, annual or monthly prepayments to see how they reduce your costs and repayment time.You can see the allocation of your total payments at any point in time and the total costs over the life of the loan. The total cost/interest of the loan: Click the “Schedule” tab and move the slider to see how your loan balance falls over the life of the loan.But the monthly payment is higher and might not be affordable to you. A 15-year loan, for instance, has a lower interest rate and much lower total interest costs than a 30-year loan. Deciding what type of mortgage to get: Mortgage programs offer a combination of advantages and drawbacks.And by clicking the “Affordability” tab, you’ll see if the home is affordable to you based on typical mortgage lender guidelines. Determining how much of your home you can afford: You can play around with different loan amounts (like jumbo loans) and interest rates to see how they translate into a monthly payment.Other factors, like HOA fees and insurance, may help you get the most accurate estimate. In general, when using a mortgage calculator, you'll need to know the home price, your downpayment amount and the interest rate. You can use a mortgage calculator when shopping for or purchasing a home, considering when to pay off your mortgage, and when determining the type and length of home loan to apply for. Mortgage calculators help you with many steps of your home purchase and allow you to make informed choices. Additional hidden costs might include higher utility charges, lawn and yard services, higher cleaning costs and new furniture. To make costs more predictable, consider purchasing a home warranty. You can estimate potential expenses with one of two formulas: either 1% of the home price per year, or $1 per year for every square foot of space. Maintenance and repairs often surprise first-time buyers. However, a simple mortgage calculator does not incorporate all homeownership costs. You’ll be paying property taxes and homeowners insurance, and possibly other costs - like private mortgage insurance (PMI) premiums, homeowners association (HOA) dues and flood insurance charges. Those include more than just principal and interest. What expense can you cut to make your home purchase affordable?Ī mortgage payment calculator reveals the different components of a prospective mortgage payment. If your home purchase will increase your housing costs, for instance, you need to determine where you’ll find the extra money. Budgeting helps you head off problems and keeps you from getting in over your head financially. Using a mortgage payment calculator helps you establish a budget before buying a home.

0 kommentar(er)

0 kommentar(er)